What is a Blockchain?

Blockchain, a powerful new technology, Experimental Blockchain reduces global costs and transforms the world economy as we move increasingly to a cashless society. AI and Blockchain technology has the potential to dramatically cut costs and time required in conducting global business transactions, as well as to reduce counterparty risk associated with traditional banking/payment networks.

Cross-border payments will arrive within 5 days approximately and this timeframe is dependent on the number of intermediary banks involved in processing cross-border transactions. Experimental Blockchain or eli5 blockchain offers to solve many such problems observed in today’s transaction processing systems. It also considers barriers to its adoption and the security implications of using blockchain technology.

What exactly is blockchain in the context of banking?

Blockchain technology is a type of distributed ledger that allows users to make transactions (such as payments) directly, without the need for a third-party intermediary. It offers users more control over their transaction data and enables banks to cut costs in some areas.

Blockchain distributed ledger technology is not synonymous with Bitcoin. While the two terms often used interchangeably, in fact, both are very different. The Blockchain is the underlying technology for Bitcoins. It is a distributed ledger that records and verifies transactions in a permanent and transparent way, making it possible to trace back to their origin.

How can banking benefit from blockchain technology?

Banks can use bitcoin blockchain technology to reduce costs, increase efficiency and simplify the process of storing, securing, and transferring money. Blockchain can also be used as a digital ledger for other financial instruments such as bonds or stocks.

What are the use-cases of blockchain in the banking sector?

Become blockchain analysts has used by banks, financial institutions, and even governments to perform their operations more efficiently and securely. Here’s the guide for how to use blockchain technology in businesses, We are using blockchain in the banking sector.

Remittances

A blockchain can be used to track the remittance process from start to finish. It can also increase the transparency in this process. Since records cannot be tampered with, neither can the fees charged for remittance transfers; thus making it easier for customers and reducing their costs too.

Interbank settlements

Blockchain technology can help banks reduce their settlement times from days to minutes by enabling instant interbank clearing and settlements. It can also be used for peer-to-peer payments as well as other bank payment transactions.

Cash management

Blockchain technology can help banks improve their cash management process by offering real-time liquidity monitoring. This will help them avoid any mismatches between cash inflows and outflows, thereby improving their liquidity management capabilities.

Money Transfer

Blockchain can make money transfer more efficient and cheap by eliminating the need for a third party. The sender and receiver will be able to transfer funds directly to one another.

Payment Processing

Experimental Blockchain will enable banks to process payments faster, easier and cheaper by eliminating the need for a third party. For example, Bank A can send money directly to Bank B without involving an intermediary or broker like Western Union.

Advance Trade Finance

Banks’ trade finance processes are very complex and it takes weeks before goods are shipped because of the need for physical documents that have to be sent from one place to another using couriers. The blockchain will be able to record international trade data digitally, securely, and efficiently in real-time. So goods shipped immediately after receiving payment for goods without waiting for documentation processing.

Blockchain’s Ability to Disrupt the Banking Industry

Challenges in Cross-border Banking

The challenges faced by cross-border payment transactions are many and varied. There are problems such as:

1) Lack of access to the banking system in a particular country or region.

2) Lack of trust between parties involved in the transaction because of past experiences with local banks.

3) Inability of the parties involved in the transaction to find an entity that can act as a trusted third party for dispute resolution.

4) Non-acceptance of credit cards across borders because of high transaction fees charged by credit card companies.

5) Cross-border transactions is a time taking process due to time zone differences among countries. For example, if a purchase is placed from a country with 8 hours time difference from the US, then the purchase will not be finalized until 16 hours later when it’s 8 am on the east coast of the US. With Bitcoin and Experimental Blockchain technology, these problems become irrelevant.

How can Blockchain Reshape the Banking Industry?

Blockchain offers a frictionless payment environment that delivers on speed, security, and transparency.

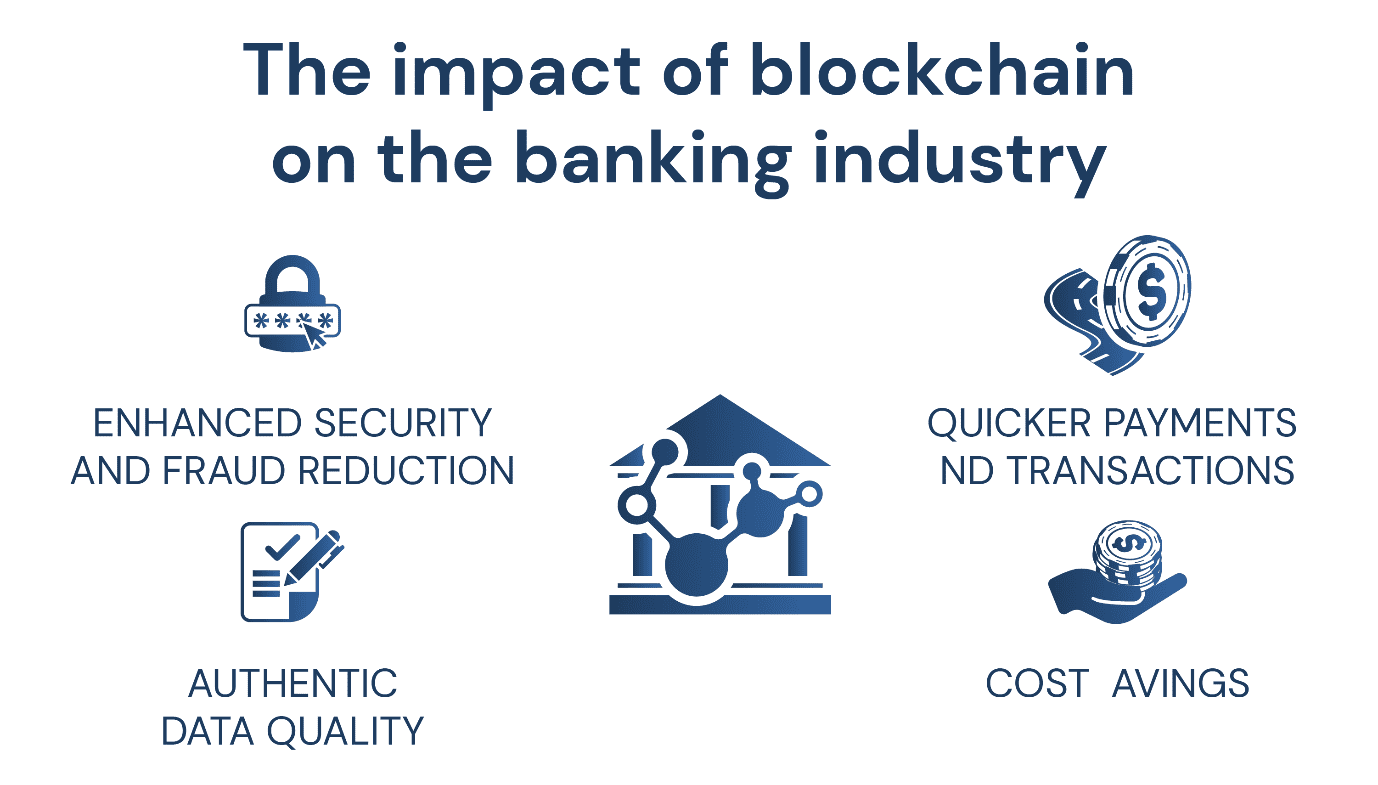

Enhanced Security and Fraud Reduction

how secure is blockchain technology?

Experimental Blockchain technology uses encryption techniques, making it impossible for hackers to access sensitive information stored on a blockchain network. This makes it more secure than other banking system solutions such as credit cards or online banking solutions.

Quicker Payments and Transactions

Requiring only the email address/private key/output address of someone you want to transact with, blockchain banking allows you to send and receive money from whomever you want without extensive documentation checks required by traditional banks.

Authentic Data Quality

The authenticity of payment data depends on four key features of blockchain technology: immutability, transparency, decentralization, and irreversibility.

Immutability means that once a transaction has recorded in the blockchain ledger. Since there is no central authority issuing new money or controlling transactions, decentralized peer-to-peer networks spread around the world are responsible for issuing currency and verifying transactions. Since all transactions are final, irreversibility means that if a user sends $100 to another user, that other user cannot undo the transaction and send $100 back.

Cost savings

An Experimental Blockchain distributes across many nodes on a network. Each node holds an identical copy of the ledger and processes real-time transactions. This process eliminates costly fees charged by banks or other financial institutions for processing payments.

The Future of Blockchain in Banking

The «internet of value» created by blockchain technologies has the potential to impact businesses beyond banking and financial services. How can businesses prepare for this new reality? According to the Digital Economy Report by UNCTAD-2019, 10% of global GDP could be stored on blockchain technologies by 2027. The World Economic Forum estimates that blockchains could save the ten largest banks $8 billion per year through cost reductions in areas such as processing and settlement.

According to the report, banks could save up to 70% on financial reporting, 50% on compliance, and 50% on business operations like settlement and clearing.

Future Applications of Blockchain Technology in Banking

Blockchain technology is arguably most famous for being the underlying system behind Bitcoin, but it has a lot of potential beyond that. In the last several years, the technology has evolved and new applications have emerged, including digital currencies (like Litecoin or Dogecoin) and other cryptocurrencies.

The next step in this evolution is the introduction of non-fungible tokens (NFTs). As a non-fungible token (NFT) owner, you are the sole authority over your digital assets. Now the technology is setting to disrupt the gaming industry, which has yet to adopt cryptocurrencies in a meaningful way. Currently. moreover, NFTs solve that problem and could open up a multi-billion dollar market opportunity for crypto and decentralized tech companies and blockchain penetration testing.